Same River, New Promises, Familiar Smell The Tijuana River has never needed much help making its presence known. You don’t …

Same River, New Promises, Familiar Smell The Tijuana River has never needed much help making its presence known. You don’t …

If there’s one thing that consistently confuses newcomers, long-timers, and every hungry traveler stuck in the dairy aisle at Calimax, …

Rumors in Baja move fast, but sometimes fugitives move faster — at least until the cops slam the brakes on …

From money to matrimony, nobody’s flying under the radar anymore. You may have seen the headlines already. Something about banks …

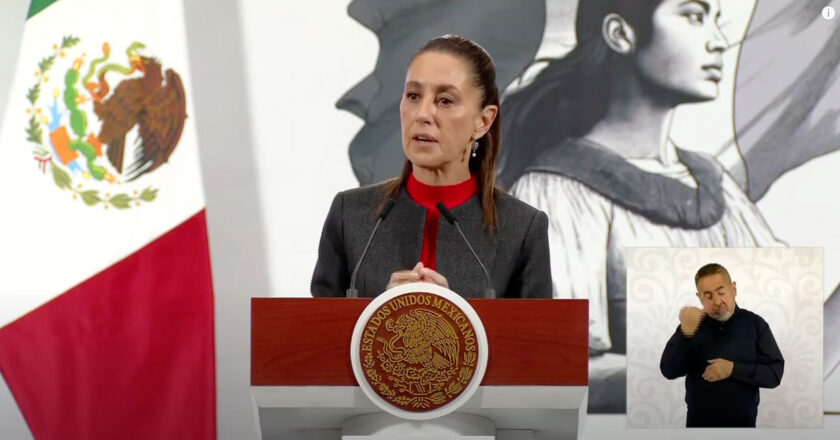

Mexico’s new president scores a diplomatic win—but the accusations are still on the table In what’s being called a behind-the-scenes …

If you blinked, you missed it. Just two days after the U.S. began reopening ports to Mexican cattle, the border …